Sound finances are essential to lead a good daily life and make larger purchases. The first step to good financial basis is fairly easy to understand. You have to work and generate a decent income. The second step is to decide what to do with this money. And this part provides for most people some difficulties because of a lack of expertise. Now, it is definitely possible to go to your bank and ask a financial consultant to organize your finances. But the financial consultant has not necessarily only your interest in mind; he/she also thinks of the bank’s profit. Anyway, it is you who must and should make the final decisions when it comes to your money. In this article you find two powerful methods which will help you to analyze and plan your daily earnings and expenditures and your long-term finances.

Fundamentals of Financial Analysis and Planning for Private Households

by godbersen

Often, it is better to think about your finances for an hour than to work for it a week. Learn more about the basic instruments to organize and optimize your private finances.

Household Budgeting

When it comes to your daily money the financial instrument of choice should be a household budgeting tool. In such a private budget you simply list all of your earning and expenditures. As a result you will see an account balance which indicates how much money you save or in a bad case how much credit you need to cover the expenditures of your daily life.

The three key factors for household budgeting which have a positive impact on optimizing your daily finances are:

- Frequent and comprehensive work on the budget

- Well-structured categories of earnings and expenditures

- The right method to uncover potentials for savings

It is more or less self-explanatory that your private budget must be comprehensive and on a regular basis. Otherwise you would miss some of your financial transactions so that you cannot properly evaluate your potentials for savings. The same applies to the structure of earnings and expenditures. Only with a systematic approach over time you are able to uncover room for improvement in your daily finances.

On the basis of the three points made above you can evaluate your savings potential. Eventually, you have to ask yourself if the benefits you gain out of purchases is worth the money you have spent and if you could use your money more appropriate to your needs. This method is called the subjective evaluation of savings potential. However, it is advised that you rely the objective approach in the first step because it is an easier method based on hard data. You need to compare your expenditures of a certain category with the average spending of a reference group, for example families with children. If you send more than the average it is a good indicator that you face a potential for savings.

Learn more in the Video Household Budgeting and Private Financial Planning – Content:

1. Household Budgeting

- The Basic Structure of Household Budgeting

- Subjective and Objective Potentials for Savings

2. Private Financial Planning

- ...

Here you find additional information about household budgeting.

Video: Household Budgeting and Private Financial Planning

Systematic Financial Planning

After you have organized and optimized your daily finances through household budgeting you should have a closer look into your long-term financial plan.

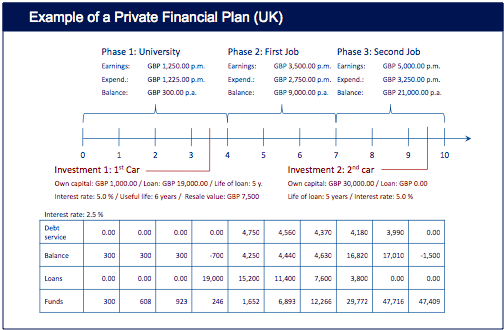

Firstly, this has nothing to do with sophisticated methods of financial analysis. Keep in mind that your finances should serve your life and not the other way around. Therefore, draw a rough plan of your life and structure it by defining phases of life. For example, when do you go to university, when do you have children, what is your career plan, when do you plan to retire etc. Then add your assumed income and predicted regular expenditures to these phases. From this data you can see how much you will probably save during the several phases of life. This money is the basis for financing larger purchases like a car, a house etc.

In the second step plan the just mentioned bigger investments. Again, it firstly depends on your plan of life and not on your finances when you make a certain purchase. However, you need to the financial ability to make these investments. From the plan of your phases of life and the referring regular financial transactions you can see how much money you will save over the years. This informational basis lets you know how much money you could contribute to financing a larger purchase through own funds and what the further required loan amount would be. When you make your long-term financial plan you should keep in mind that you earn interest on your savings and that you are charged with interest on your loans.

Learn more in the Video Household Budgeting and Private Financial Planning – Content:

1. Household Budgeting

- …

2. Private Financial Planning

- The Triangle of Objectives of Financial Planning

- The Process of Private Financial Planning

- The Elements and Structure of Financial Planning

Here you find additional information about private financial planning.

Example of a Private Financial Plan

LifeWorld Money & Finance |

You might also like

How to deal with Collection Agencies, especially when they ste...Collection agencies are companies who specialize in collecting unpaid debt fo...

Roadshow aims to attract British entrepreneurs to crowdfundingAn American crowdfunding company has started a campaign with the aim of getti...

The Single Euro Payments Area Migration Date ExtendedDetailed Information about SEPA (Single Euro Payments Area) migration date ex...

Stop Smoking with the Cognitive and Behavioral Therapyon 05/20/2013

Stop Smoking with the Cognitive and Behavioral Therapyon 05/20/2013

What to Do When We Lose Our Freedom: The Principle of Reactance:on 05/20/2013

What to Do When We Lose Our Freedom: The Principle of Reactance:on 05/20/2013

The Seven Aspects of Assertive Communicationon 04/03/2013

The Seven Aspects of Assertive Communicationon 04/03/2013

Burnout in Caring and Social Professionson 03/06/2013

Burnout in Caring and Social Professionson 03/06/2013

Comments