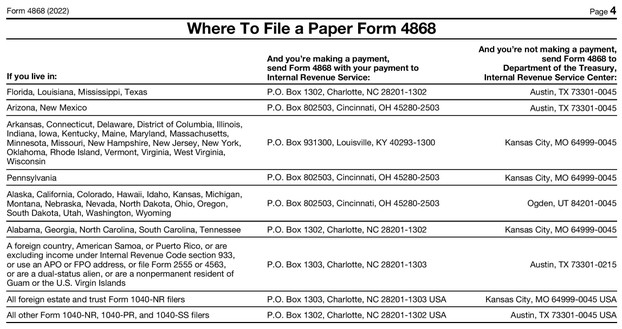

Mailing addresses for 2022 Form 4868 filed in 2023, due date Tuesday, April 18, are provided for the benefit of taxpayers applying in paper format for an extension of the April 18 due date for federal individual income tax return forms 1040 and 1040SR.

Form 4868, entitled Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, allows an automatic extension to federal individual income taxpayers for filing forms 1040 and 1040SR. The extension is available to taxpayers who owe tax as well as to taxpayers who expect refunds when they file forms 1040 and 1040SR.

Form 4868 extends the due date for filing completed forms 1040 and 1040SR. The extension does not extend the due date for payment of any owed taxes. Inclusion of full or partial payment of owed taxes, however, is not required for filing Form 4868 by taxpayers who estimate that they owe tax on their federal individual income returns.

"An automatic 6-month extension to file doesn't extend the time to pay your tax. If you don't pay your tax by the original due date [Tuesday, April 18, 2023] of your return, you will owe interest on the unpaid tax and may owe penalties," according to "What If You Can't File on Time?" (page 8) in Tax Year 2022 1040 (and 1040-SR) Instructions booklet, published Dec. 23, 2022, by the U.S. Department of the Treasury's Internal Revenue Service.

IRS help line telephone number for individuals: 800-829-1040

Open Monday through Friday, 7:00 a.m. to 7:00 p.m. local time

Alaska and Hawaii residents should follow Pacific Time

Puerto Rico phone lines open 8:00 a.m. to 8:00 p.m. local time

IRS website: https://www.irs.gov/

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

All those who are filing 2022 Form 4868 to extend the filing deadline for 2022 forms 1040 and 1040SR: Please remember that the paper formatted-Form 4868 must be postmarked by midnight, Tuesday, April 18, 2023.

Your comments are greatly appreciated, especially as you are an expert at presenting resources helpfully and interestingly in your wizzleys.

WOW, this is brilliant and very helpful. Tax issues can be confusing. It is nice to have an in-house expert. And yes retaining and being aware of such facts and resources is expert!

For questions from taxpayers about filing 1040-X if you need to make changes in the 1040 or 1040SR that you filed or will file during your six-month extension:

Form 1040-X Amended U.S. Individual Income Tax Return may be filed in paper or electronic format.

Form 1040-X is available here: https://www.irs.gov/pub/irs-pdf/f1040...

For taxpayers who realize, after filing their 2022 forms 1040 and 1040SR, that they need to make changes:

Do not submit another form 1040 or 1040SR.

You need to file Form 1040-X to make corrections to an already-filed 1040 or 1040SR.

Form 1040-X is titled Amended U.S. Individual Income Tax Return.

For taxpayers who have already filed Form 4868 and who are ready to file their 2022 forms 1040 and 1040SR:

Remember: Do not attach a copy of Form 4868 when you file your 1040 or 1040SR tax returns.

As stated on page 2 of Form 4868:

"Filing Your Tax Return

You can file your tax return any time before the extension expires. Don’t attach a copy of Form 4868 to your return."

For taxpayers who filed Form 4868:

Form 4868 generally extends the due date to Oct. 18, 2023, for calendar year 2022 tax returns.

Form 4868 instructions state: "You can file your tax return any time before the extension expires. Don’t attach a copy of Form 4868 to your return."

For taxpayers who haven't filed their 2022 forms 1040 and 1040SR:

Remember that the extension via Form 4868 only extends the date for filing a completed return. The extension is available for taxpayers expecting to owe tax as well as taxpayers expecting a refund.

Form 4868 does not extend the annual April due date -- which is April 18 in 2023 -- for payment of taxes owed for 2022 income.

Yes, you are correct: this is useful information because details change frequently, such as mailing addresses. Sometimes -- as happens for 2022 returns, which are filed in 2023 -- the due date changes from the standard date of April 15.

Yes, you are correct: even if taxpayers expect a refund, they still have to request an extension if they are not ready to file their tax returns by midnight, April 18, 2023.

Taxpayers who estimate that they will owe tax and taxpayers who estimate that they will receive a refund file the same form, 4868. The mailing addresses, however, differ for 4868 forms without payment enclosed or with payment enclosed.

Is there a similar situation in India, where taxpayers can request extensions on due dates for filing their returns?

This must be quite useful information for Tax Payers in US. Looking at the article it seems - if one is not paying taxes, he or she still need to fill the form albeit a different one.

For taxpayers considering filing Form 4868: Remember that there are three ways to apply for the extension available via Form 4868.

1. You may mail a paper formatted-Form 4868.

2. You may indicate your interest in the extension by filing the form electronically.

3. You may make an electronic payment accompanied with a statement indicating an extension is requested. Filing Form 4868 is not required with this option.