Mailing addresses for 2022 forms 1040 and 1040SR filed in 2023, due date Tuesday, April 18, are provided for the benefit of taxpayers who choose to submit their 2022 federal individual income tax returns in paper format.

April 15, known as Tax Day, is the standard annual due date for filing U.S. federal individual income tax returns. Exceptions apply.

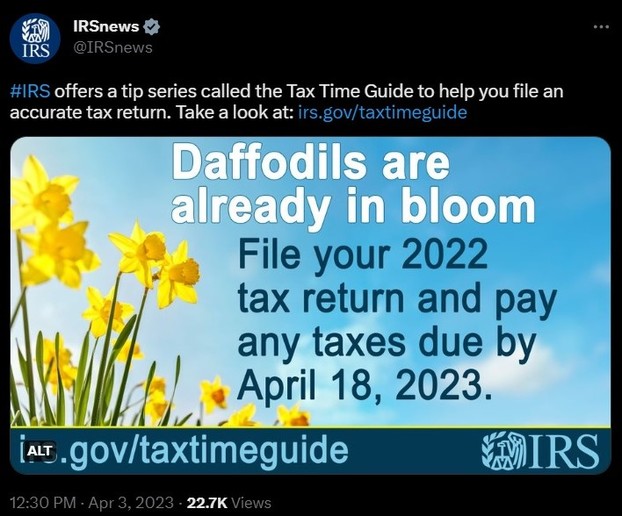

In 2023, Tuesday, April 18, is designated as the deadline for filing U.S. Individual Income Tax Return forms 1040 and 1040SR. The celebration of the Emancipation Day holiday, observed annually on April 16 in Washington D.C., necessitated setting Tuesday, April 18, as Tax Day for 2022 forms 1040 and 1040SR filed in 2023.

"File Form 1040 or 1040-SR by April 18, 2023. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia -- even if you don't live in the District of Columbia," according to "When and Where Should You File?" (page 8) in Tax Year 2022 1040 (and 1040-SR) Instructions booklet, published Dec. 23, 2022, by the U.S. Department of the Treasury's Internal Revenue Service.

The federal district's Emancipation Day holiday celebrates and commemorates the District of Columbia Compensated Emancipation Act signed Wednesday, April 16, 1862, by U.S. President Abraham Lincoln. "Beginning in the year 2007, District of Columbia Emancipation Day, April 16th of each year" states the Code of the District of Columbia § 1–612.02 Legal public holidays.

IRS help line telephone number for individuals: 800-829-1040

Open Monday through Friday, 7:00 a.m. to 7:00 p.m. local time

Alaska and Hawaii residents should follow Pacific Time

Puerto Rico phone lines open 8:00 a.m. to 8:00 p.m. local time

IRS website: https://www.irs.gov/

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

All those who are filing 2022 forms 1040 or 1040SR: Please remember that your tax returns need to be postmarked by midnight, Tuesday, April 18, 2023.

Oh my. Here, the first $12,950 (+/- £10,424) for under 65 and the first $14,700 (+/- £11,833) for 65 or older are excluded.:-(

We do not pay tax on at least the first £12,500 a year.

It's nice not to have to fill out those forms. And that makes retirement easier that your pension authorities furnish your details to HMRC.

Also, the further easing of retirement via eligibility for "thousand pounds tax free self employed earnings per year free of tax" is impressive. That tax-free incentive for engaging in a little work during retirement provides a nice cushion and comes across as a reward for all the years of pre-retirement work.

The PAYE system sounds impressive.

There is always finessing with tax withholding on this side of the pond, so that taxpayers usually have to file a return either for a refund because too much was withheld or for payment of tax due because too little was withheld.

There also are taxpayers who intentionally have too much withheld because they want to file for refunds. It's my understanding that making a special purchase numbers among one of the reasons for overwithholding for refunds.

The allowance of almost nine and one-half months in which to pay owed tax comes across as rather thoughtful.

Only about three months is allowed for timely tax payments on this side of the pond. For instance, the Internal Revenue Service began accepting 2022 tax returns as of Jan. 23, 2023. Taxes owed are due April 18, instead of the standard April 15 this year because of the annual celebration of Washington DC's Emancipation Day.

Paying your tax in June removes that item from your year's to-do list early. Also, you don't have to carry it into the new year.:-)

After years of paying self employed tax In January and July I retired to live off my pensions.No more filling in of forms. The pension authorities simply submit my details to HMRC (his majesty's revenue and customs.) I am allowed a thousand pounds tax free self employed earnings per year free of tax.

YES, if you work for an employer the employer has you on a pay-as-you-earn PAYE scheme and you never have to fill in a tax form. Self-employed people do have to.

Yes indeed it is. 31st Jan is the last date. I pay mine in the June before January 31st.

That's a nice length of time between the end of the tax year and the due date on owed taxes. Is it possible to pay owed taxes before January 31, 2024 -- :-{ -- if you want to?

According to Wikipedia's Tax return (United Kingdom) article, employees "paying tax under the PAYE system are not required to file a tax return, because the PAYE system operates to withhold the correct amount of tax from their wages or salaries." But the article specifies that income not taxed at the source "needs to be declared to HMRC, usually by submitting a self assessment tax return."

A Self-Assessment tax return form -- interesting contrast to the Internal Revenue Service's "Form 1040 U.S. Individual Income Tax Return."

It is very interesting to see how your tax system compares and contrasts with ours. Thank you for posting this. It is a very thorough piece.

I am "self-employed " so I have to submit my tax return . Our tax year starts and ends on April 5th. Unless a Brit has a different submission date, I have to pay my tax for the year 22/23 by 31st January 2024.