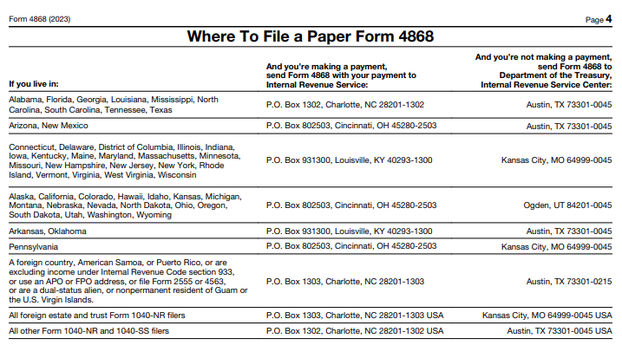

Mailing addresses for 2023 Form 4868 filed in 2024, due date Monday, April 15, are provided for the convenience of taxpayers applying in paper format for an extension of the April 15 due date for federal individual income tax return forms 1040 and 1040SR.

Form 4868, entitled Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, avails an automatic extension to federal individual income taxpayers for filing forms 1040 and 1040SR. The extension applies to tax-owing taxpayers as well as to refund-expecting taxpayers.

Form 4868 extends the due date for the filing of completed forms 1040 and 1040SR. The extension does not extend the due date for payment of owed taxes.Taxpayers who estimate that they owe tax on their federal individual income returns, however, are not required to include full or partial payment of owed taxes in filing Form 4868..

"You can get an automatic 6-month extension if, no later than the date your return is due, you file Form 4868," according to "What If You Can't File on Time?" (page 8) in Tax Year 2023 1040 (and 1040-SR) Instructions booklet, published Dec. 27, 2023, by the U.S. Department of the Treasury's Internal Revenue Service. "An automatic 6-month extension to file doesn't extend the time to pay your tax. If you don’t pay your tax by the original due date of your return, you will owe interest on the unpaid tax and may owe penalties."

IRS help line telephone number for individuals: 800-829-1040

Open Monday through Friday, 7:00 a.m. to 7:00 p.m. local time

Alaska and Hawaii residents should follow Pacific Time

Puerto Rico phone lines open 8:00 a.m. to 8:00 p.m. local time

IRS website: https://www.irs.gov/

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

All those who are filing 2023 Form 4868 to extend the filing deadline for 2023 forms 1040 and 1040SR: Please remember that the paper formatted-Form 4868 must be postmarked by midnight, Monday, April 15, 2024.

You're welcome, Tolovaj! Thank you for the visit and the appreciation.

P.S. Might there be any fairy tales about tax collectors ;-D?

Oh, my! I hate paperwork and doing taxes is not the way I would like to spend time. Thank you for this valuable info.

Taxpayers who requested a six-month extension of the due date of their Form 1040 or Form 1040-SR via Form 4868:

Remember that you may file your completed form at any time during the six months.

For federal form 1040, 1040-SR and Form 4868 taxpayers who live in Maine or Massachusetts: Wednesday, April 17, has been designated as the 2024 due date for filing forms 1040 and 1040-SR and also for filing for a six-month extension with Form 4868 for form 1040 and 1040-SR filers living in these two New England states.

"File Form 4868 by April 15, 2024 (April 17, 2024, if you live in Maine or Massachusetts)" (Form 4868, "When To File Form 4868," page 2).

"Due date of return. File Form 1040 or 1040-SR by April 15, 2024. If you live in Maine or Massachusetts, you have until April 17, 2024, because of the Patriots’ Day and Emancipation Day holidays" (Publication 17: Tax Guide 2023 for Individuals, "1. Filing Information: What's New: Due Date of Return," page 6).

For Form 4868 filers: Remember that taxpayers who (1) want the IRS to figure their tax or (2) are required by a court order to file by the 2024 standard due date of Monday, April 15, are excluded from eligibility for filing Form 4868.

"Don’t file Form 4868 if you want the IRS to figure your tax or you’re under a court order to file your return by the regular due date" (Form 4868, "General Instructions: Qualifying for the Extension," page 1).

For Form 4868 filers: Remember that fiscal year taxpayers are required to file Form 4868 in paper format. The other two filing options of electronic filing or making a full or partial electronic payment -- are not available to fiscal year taxpayers seeking the six-month extension on their Form 1040 or Form 1040-SR returns.

"Note: If you’re a fiscal year taxpayer, you must file a paper Form 4868" (Form 4868, "File a Paper Form 4868," page 1).

For Form 4868 filers: Remember that you may file your Form 1040 or Form 1040-SR at any time within the extended six months.

"You can file your tax return any time before the extension expires" (Form 4868, "Filing Your Tax Return," page 2).

For Form 4868 filers: Remember that your Form 4868 is not attached when you do file your Form 1040 or Form 1040-SR.

"Don’t attach a copy of Form 4868 to your return" (Form 4868, "Filing Your Tax Return," page 2).

For taxpayers considering filing Form 4868: Remember that you are not required to give a reason for requesting an extension.

"You don’t have to explain why you’re asking for the extension.

We’ll contact you only if your request is denied" (Form 4868, "General Instructions: Qualifying for the Extension," page 1).