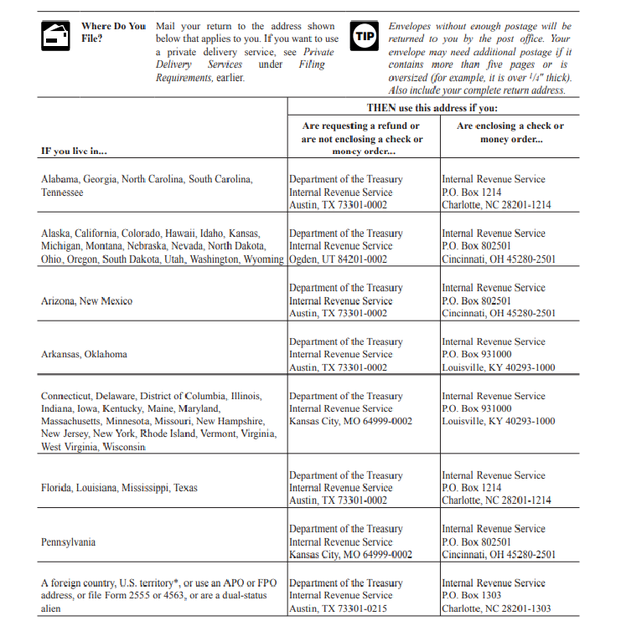

Mailing addresses for 2023 forms 1040 and 1040SR filed in 2024, due date Monday, April 15, are provided for the benefit of taxpayers who choose to submit their 2023 federal individual income tax returns in paper format.

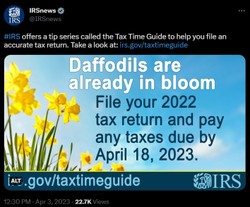

Known as Tax Day, April 15 is the standard annual due date for filing U.S. federal individual income tax returns. Exceptions exist. For example, in 2023, the celebration of the Emancipation Day holiday, observed annually on April 16 in Washington D.C., occasioned the designation of Tuesday, April 18, as the deadline date for filing 2022 U.S. Individual Income Tax Return forms 1040 and 1040SR.

In 2024, the April 15 deadline is extended to Wednesday, April 17, for residents of Maine and Massachusetts. The deadline extension recognizes their annual observance of Patriots' Day, according to IRS Tax Year 2023 1040 (and 1040-SR) Instructions ("When and Where Should You File," page 8). Patriots' Day, observed on the third Monday in April, commemorates the American Revolutionary War's Battles of Lexington and Concord.

IRS help line telephone number for individuals: 800-829-1040

Open Monday through Friday, 7:00 a.m. to 7:00 p.m. local time

Alaska and Hawaii residents should follow Pacific Time

Puerto Rico phone lines open 8:00 a.m. to 8:00 p.m. local time

IRS website: https://www.irs.gov/

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

Mailing Addresses for 2022 Forms 1040 and 1040SR Filed in 2023on 04/13/2023

All those who are mailing 2023 forms 1040 or 1040SR: Please remember that your tax returns need to be postmarked by midnight, Monday, April 15, 2024.

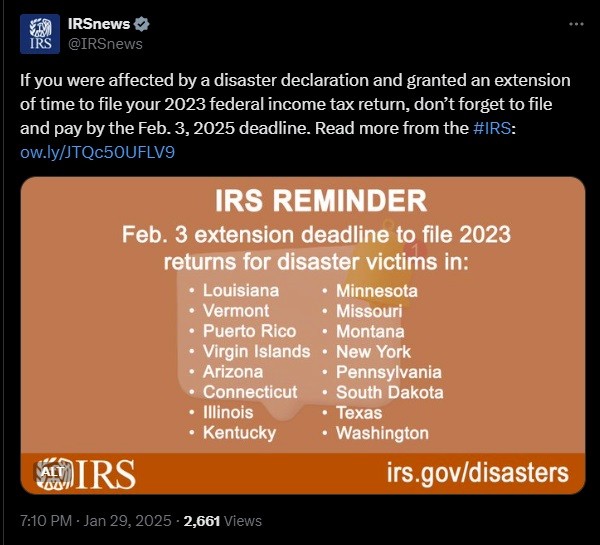

For those who were granted extensions on 2023 federal income tax returns due to disaster declarations:

Per IRSNews, posted Wednesday, Jan. 29, 2025, via X (formerly Twitter) (URL: https://x.com/IRSnews/status/18847559...):

"If you were affected by a disaster declaration and granted an extension of time to file your 2023 federal income tax return, don’t forget to file and pay by the Feb. 3, 2025 deadline. Read more from the #IRS: https://ow.ly/JTQc50UFLV9"

The extension deadline of Monday, Feb. 3, 2025, pertains to disaster victims in 14 states and two U.S. territories.

14 states::

Arizona

Connecticut

Illinois

Kentucky

Louisiana

Minnesota

Missouri

Montana

New York

Pennsylvania

South Dakota

Texas

Vermont

Washington

two U.S. territories:

Puerto Rico

Virgin Islands

The 2023 income tax returns were due April 15, 2024, but it's 2025, and you have not yet filed returns for your 2023 income. What do you?

The IRS answers this question in the agency's website post "Filing past due tax returns" (https://www.irs.gov/businesses/small-...:

"File your past due return the same way and to the same location where you would file an on-time return.

"If you have received a notice, make sure to send your past due return to the location indicated on the notice you received."

For taxpayers who have not received their expected refunds:

If you have not received your refund, did you request the refund as a check and did you move after filing your 1040 or 1040SR tax return?

Unless notified otherwise, the IRS mails checks to the address on the tax return. Undeliverable checks are returned to the iRS.

To correct this situation, file Form 8822 Change of Address. The form is available via the IRS at https://www.irs.gov/pub/irs-pdf/f8822...

Taxpayers who requested a six-month extension of the due date of their Form 1040 or Form 1040-SR via Form 4868:

Remember that you may file your completed form at any time during the six months.

For potential filers whose status (single, married filing jointly, married filing separately, head of household, qualified surviving spouse) changed during the year: Your filing status is determined by your situation on the last day of the year. Accordingly, 2024 filings of Form 1040 or Form 1040-SR are determined by the filer's status on Dec. 31, 2023.

"Your filing status is determined on the last day of your tax year, which is December 31 for most taxpayers" (Publication 17: Tax Guide 2023 for Individuals, "Do I Have To File a Return? Individuals -- In General: Filing Status," page 7).

Remember that the five federal filing statuses have different gross income requirements. The lowest gross income requirement of "at least $5" applies to those who are "married filing separately."

"If you didn't live with your spouse at the end of 2023 (or on the date your spouse died) and your gross income was at least $5, you must file a return regardless of your age" (Publication 17: Tax Guide 2023 for Individuals, "Do I Have To File a Return? Table 1-1. 2023 Filing Requirements for Most Taxpayers," page 7).

For those who are not required to file Form 1040 or Form 1040SR: Overwithholding, in which the amount of federal taxes withheld during the year exceeds the taxes that are owed, results in refunds.

But if you are not required to file a return, you will only receive the refund by filing Form 1040 or Form 1040-SR. The IRS will not contact you to inform you about refunds. You must file in order to claim your refund.

"Refund on a late-filed return. If you were due a refund but you did not file a return, you must generally file your return within 3 years from the date the return was due (including extensions) to get that refund" (Publication 17: Tax Guide 2023 for Individuals, "Reminders," page 3).

For federal form 1040 or 1040-SR taxpayers who live in Maine or Massachusetts: Wednesday, April 17, also has been designated as the 2024 due date for filing for a six-month extension with Form 4868 for form 1040 and 1040-SR filers living in these two New England states.

"File Form 4868 by April 15, 2024 (April 17, 2024, if you live in Maine or Massachusetts)" (Form 4868, "When To File Form 4868," page 2).

For federal form 1040 or 1040-SR taxpayers who live in Maine or Massachusetts: Remember that the 2024 Tax Day has been extended from Monday, April 15, to Wednesday, April 17, for federal taxpayers living in these two New England states. Patriots' Day annually is celebrated on the third Monday in April. Because the third Monday in April in 2024 falls on Monday, April 15, the IRS has designated Wednesday, April 17, 2024, as the due date for forms 1040 and 1040-SR filed by taxpayers in Maine and Massachusetts.

"Due date of return. File Form 1040 or 1040-SR by April 15, 2024. If you live in Maine or Massachusetts, you have until April 17, 2024, because of the Patriots’ Day and Emancipation Day holidays" (Publication 17: Tax Guide 2023 for Individuals, "1. Filing Information: What's New: Due Date of Return," page 6).