U.S. Department of the Treasury Internal Revenue Service. "2024 Instructions for Form 2555 Foreign Earned Income 2024." Catalog Number 11901A. June 21, 2024. Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f2555.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 1040 U.S. Individual Income Tax Return 2024." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f1040.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 1040-SR U.S. Tax Return for Seniors 2024." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f1040s.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 2555 Foreign Earned Income 2024." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f2555.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 2555 Foreign Earned Income 2024." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f2555.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 2555 Foreign Earned Income 2024." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f2555.pdf

U.S. Department of the Treasury Internal Revenue Service. "Form 4563 (Rev. September 2024) Exclusion of Income for Bona Fide Residents of American Samoa." Internal Revenue Service > Forms and Publications.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/f4563.pdf

U.S. Department of the Treasury Internal Revenue Service. Tax Guide 2024 for Individuals: Your Federal Income Tax for Individuals for Use in Preparing 2024 Returns. Publication 17. Catalog Number 10311G. Washington DC: U.S. Government Printing Office (GPO), Jan. 22, 2025.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/p17.pdf

U.S. Department of the Treasury Internal Revenue Service. Tax Guide for Individuals With Income From U.S. Possessions for Use in Preparing 2023 Returns. Publication 570. Catalog Number 15118B. Washington DC: U.S. Government Printing Office (GPO), Feb. 8. 2023.

- Available via IRS @ https://www.irs.gov/pub/irs-prior/p570--2023.pdf

U.S. Department of the Treasury Internal Revenue Service. Tax Year 2024 1040 (and 1040-SR) Instructions. Washington DC: U.S. Government Publishing Office (GPO), Dec. 16, 2024.

- Available via IRS @ https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Are Hawaiian Huakai Po Nightmarchers Avenging Halloween Thursday?on 10/02/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

Mailing Addresses for 2023 Form 4868 Extending 1040 and 1040SR April 15, 2024, Due Dateon 04/15/2024

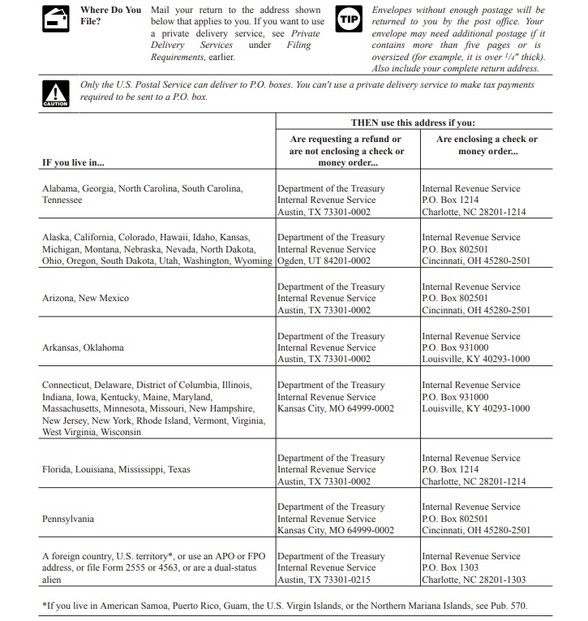

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2023 Forms 1040 and 1040SR Filed in 2024on 04/15/2024

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

Mailing Addresses for 2022 Form 4868 Extending 1040 and 1040SR April 18, 2023, Due Dateon 04/13/2023

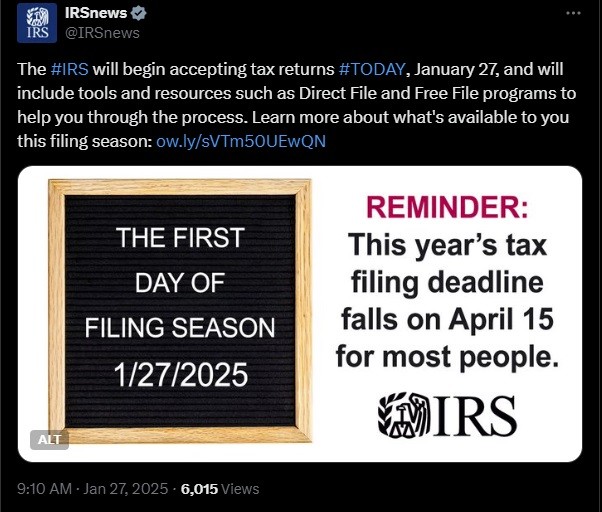

All those who are mailing 2024 forms 1040 or 1040SR: Please remember that your tax returns need to be postmarked by midnight, Tuesday, April 15, 2025.