Generally, car loans follow similar rules and procedures as other types of loans. Many people apply for car loans when buying a car, but one can also use a personal loan for the same purpose. When you apply for auto loans, the lenders will specify the repayment period, which is usually between 24 and 60 months. In some cases, you may be required to repay your loan in a longer duration.

5 Ways to Avoid Car Loan Penalty

by RobertKeith

People sometimes tend to forget their responsibilities especially when it comes to paying loans here are some tips to avoid penalties on car loans.

Car loans generally include additional fees and taxes, which are added to the total loan amount. If you have extra cash, it’s always advisable to repay your debts. There are many benefits to paying your car loan early. First, this is a good way of saving money, as you will no longer pay interest. Note that interest will only buy you some time to pay off your debt.

Would you like to improve your financial strength? One of the ways of achieving the objective is to pay your car loan faster. By paying the loan, you will be in a stronger financial position. This means you will have the freedom to channel the money you were using on periodic payments towards other uses in your home. Failure to pay off your car loan on time will result in penalties. Here are ways you can avoid that:

Make a Large Payment

You may be able to pay down your debt with a large sum from time to time. For example, many people use their annual tax refunds for this purpose. Alternatively, your lender can allow you to pay off your balance in one go. In such a case, you require the payoff amount. If you are uncertain about the amount, contact your lender or visit a nearby branch.

Once you have confirmed the payoff amount, check the specific payment date and the recommended steps when sending the money to the lender. In some cases, the payoff will vary depending on the day payment is received. Talking to your lender helps to avoid paying excessive amounts.

Refinance Your Auto Loan

Buying a car can help to improve your credit scores if you have been paying the amount due on time. If you would like to repay your debt early, consider refinancing to a lower rate. By doing so, it means your monthly payments will reduce. If you can pay more than your specified monthly payments, then repaying your car loan will become easier.

Some of the things you need to remember during refinancing include knowing your interest rate and checking for lower rates from financial institutions. A lower rate means the total amount payable will be less. However, this is only possible if you choose a short term loan.

Pay Your Auto Loan Bi-Weekly

Divide your monthly auto loan payment by two, and pay the amount every two weeks. By bi-weekly payments, it means you will pay 50% of your payment 26 times instead of the typical 12 annual payments. Another reason you should try the trick is that you will end up paying less interest over the loan duration.

Also, making payments every two weeks means your debt will keep decreasing, reducing the interest payable against the balance versus a single monthly payment. Increasing the bi-weekly payments will enable you to pay off the auto loan faster.

Try Snowball Debt Payments

The technique works for car loans and other types of debt. Take your lowest loan amounts, avoid any unnecessary expenses, and use any extra money to pay off your auto loan. Then, use the money you were paying towards the debt and apply it to the next loan. Once you are done repaying, use the amount you were paying towards your next auto loan until the debt is gone.

Some borrowers prefer starting with the highest interest loan, while others the shortest time to repay a debt. Both strategies can help to ensure you are debt-free. If the smallest loan is not the auto loan, paying higher interest small loan amounts means you will have more money to pay off your vehicle.

Shop for a Lower Car Insurance Rate

You could be having the lowest insurance rate available to you. However, that doesn’t necessarily mean you cannot find lower rates by other insurance providers. Experts recommend shopping for lower rates annually. This will enable you to have more money to pay off your auto loans.

Finally, as you look for classic car finance options, remember that failure to repay on time will result in penalties. Although paying off your debt is may help you to avoid such situations, it doesn’t always apply for all loans. For example, some car loans have prepayment penalties. In such cases, paying off a debt early will attract charges.

Autobiography

Eric Reyes is a passionate thought leader having been featured in 50 distinguished online and offline platforms. His passion and knowledge in Finance and Business made him a sought after contributor providing valuable insights to his readers. You can find him reading a book and discussing current events in his spare time.

You might also like

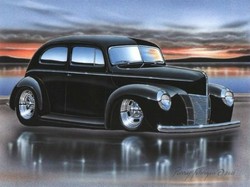

1940 Fords For Sale1940 was the year before the U.S. entered WWII. The cars that were produced i...

10 Things You Need To Have Clean and Spotless Clotheson 10/28/2021

10 Things You Need To Have Clean and Spotless Clotheson 10/28/2021

10 Business Ideas For Newbies That Will Thriveon 10/27/2021

10 Business Ideas For Newbies That Will Thriveon 10/27/2021

Comments