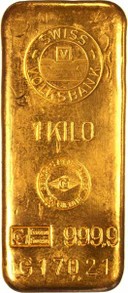

Gold is the bedrock of all finance. It has been extracted and utilised for currency, ornamentation and jewelry for millennia. It has been held in convenient bar form, from rough smelted bars, to those of 100% purity, throughout that period. With its intrinsic value it has been traded extensively and in recent years various gold bars have been produced, both for large and small investors and those that wish to hold their wealth in other than paper currency. Gold is a safe haven in times of high inflation.

The different types of bar are described below.

Creating My Own Websiteon 02/04/2021

Creating My Own Websiteon 02/04/2021

Weights and Measures of Gold Barson 10/20/2017

Weights and Measures of Gold Barson 10/20/2017

Types of Goldon 10/20/2017

Types of Goldon 10/20/2017

Ten Great English Wordson 10/19/2017

Ten Great English Wordson 10/19/2017

Comments

I like fractional gold, less then one ounce, because it s easier to find buyers when liquidation must be. Fractional coins are good for this.

If you must have gold in bar, not coin, form the Perth Mint makes the swan and the Dragon, Dragon bars are also coins, since there is a denomination printed on them.

While they take up more space per value, silver has growth possibilities, and is certainly more affordable. Have you considered silver as an alternative or to supplement a gold holding?

Great topic, and well covered.

humagaia, Thank you for the pictures, practicalities and products.

It's interesting about Brazil and Germany being gold bar manufacturers through Degussa. Perhaps their gold originates in the mineral-rich state of Minas Gerais ("general mines") and owes their operation to descendants of 20th-century German immigrants, who, like those of 19th-century southern American and 20th-century Japanese immigrants, preserve the homeland cultures and languages.

It's surprising to read about Vietnamese refugees being able to smuggle gold to then sell. They must not have been traveling by standard transportation means entailing, for example, airport security systems. But then non-standard means seem hazardous too, with the lack of protection and perhaps the suspicion that one is carrying one's assets on one's person.

Where would gold be kept by those who seek it for investment and storage?