The difficulty with budgets is that of trying to budget for every item we simply do not know how frequently we must purchase or how much some items will cost. No matter how much effort we put into the construction of a budget or how often we revise it, unplanned expenses occur that throw the budget into disarray. If the budget does not appear to be working we are quick to discard it and go back to the hit and miss method. If the amount of work and time are excessive, we lose interest and become resentful of the requirement.

Budget

by Glen

Budgets are the traditional way of matching funds available against spending. Almost any literature on financial management uses the budget process as the core of a plan.

|

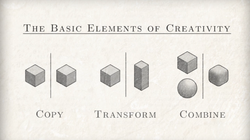

Essentially the procedure is to allocate one of three priorities to each budget expense. These are: Vital, Necessary or Lifestyle.

The Vital expenses are those essential to survival.

The Necessary expenses are those that are considered necessary to enhance and support a particular standard of living.

The Lifestyle expenses are those determined by the individual and dictated by the income available.

Lists of possible expenses are given and those applicable are chosen and given one of the three categories.

Those expenses that fall into the Vital area such as rent, mortgages, basic food expense and so on are entered into the budget.

The Necessary costs that need to be planned for are entered into the budget.

Lifestyle expenses are entered if you believe that money must be available. Smokers know that cigarettes are not essential to survival but will generally include the expense in their budget.

If expenses exceed the income, cuts are made firstly from the Lifestyle category and secondly from the Necessary category.

Why It Becomes Easy

The major reason we are inefficient in handling money is the missing pre-planned priorities.

In most other aspects of living, priorities are forced upon us. For instance, we are required to start work at a particular time and to achieve this we establish a routine commencing with the time we get out of bed.

Our mode and standard of dress are dictated by the nature of our employment. Our holidays and social lives revolve around the priorities forced upon us by the need for employment.

Our dominant thought process revolves around employment to achieve income to enable us to survive and provide. The receipt of this income, psychologically, tends to be the end objective.

This means that the actual disbursement of our income is secondary to receiving it. Our spending decisions are based upon different disciplines than those used in earning income.

It is true that no matter what our financial state, we will never be able to have all of the material possessions or experiences that we wish.

Many a millionaire has had to make do with a 45 foot yacht because he has been unable to afford a 70 footer.

We always try to enjoy the highest quality of life that our present financial status allows. It is this, more than anything else, that precludes the improvement in the quality of life that we wish to enjoy.

To overcome this obstacle, we introduce a process that follows the receipt of income. This process extends the routine that we follow to produce income and subsequently how we use it. It's very important when planning a budget.

You might also like

Avoiding Hurting Peoples' Feelings - A Dangerous Idea To Teach...The idea of hurting someone's feelings is often emphasized to kids, but it ca...

10 Ways to Keep Creative Writing Ideas FlowingTips and tricks to keep those creative juices flowing. If inspiration refuses...

6 Places to Find Writing Ideas: Never Have a Blank Page AgainRunning out of wring ideas? Here are six places to find them so you never get...

Zujavaon 12/24/2011

Zujavaon 12/24/2011

The Battle of Salamison 07/20/2011

The Battle of Salamison 07/20/2011

Diceon 07/20/2011

Diceon 07/20/2011

The 300 Spartanson 06/22/2011

The 300 Spartanson 06/22/2011

Comments