Runescape players were already familiar with much of the format, as it employed a similar game-play and investment strategy as Mobilizing Armies. But there was a stark difference.

The Runescape mini-game was funded by items produced within the wider game. War of Legends was funded by real life cash.

The microtransactions within War of Legends are really a question of how patient you are – whether you wait, or whether you want to buy it to speed up the experience.

Adam Tuckwell, Jagex PR Manager

It was all patently an experiment in alternative ways of raising capital, but didn't enjoy nearly the success that Runescape itself has over the years. Then again, it's early days yet and the experience has obviously encouraged further micro-transaction experimentation.

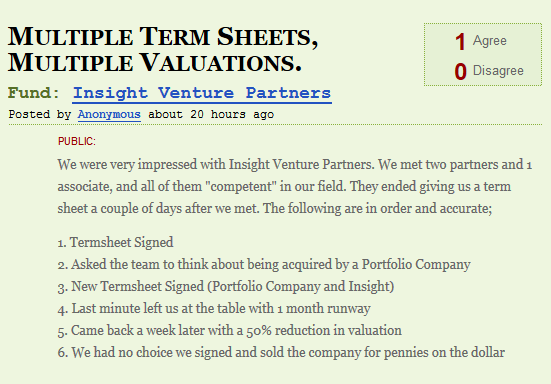

In terms of publishing, War of Legends was certainly seen as the first of many such ventures. This was made clear in the same press release, dated February 8th 2011, in which investment growth was announced via Insight Venture Partners, The Raine Group and Spectrum Equity Investors.

In addition to Jagex's in-house development, the company also acts as a third-party publisher for developers of great content. Jagex recently published its first third-party title, War of Legends, and the company intends to release numerous third-party games throughout the next 12 months.

Press Release: Jagex Limited Receives Growth Investment.

At the time, Runescape players were unaware of a deeper significance in this news release. Insight Venture Partners had only been able to extend its stake in Jagex because Andrew Gower had sold his shares to them.

Jeff Horing now effectively owned all future direction with 55% of the deciding vote in the Jagex boardroom. This also marked the moment when the tide began to turn. More and more micro-transactions were on the table in Runescape itself.

They took the form of pixel katanas available only for those who had paid real world cash for game cards; or in initiatives like Refer a Friend or the Loyalty Points scheme.Those paying to attend RuneFest also acquired items in-game. Pressure was on for free playing gamers, who were ejected from the hiscores, until such time as they bought a subscription.

It was a drip drip of infusions, which found no real expression in outrage until the Squeal of Fortune made it all way too blatant. Even the most unobservant of players were getting the picture now.

But Jagex as a third-party publisher had to be good, hadn't it? Not necessarily, no.

Jeff Horing, as a former employee of Goldman, Sachs & Co, had already earned his capital market credentials before he even co-founded Insight Venture Partners in 1995.

Jeff Horing, as a former employee of Goldman, Sachs & Co, had already earned his capital market credentials before he even co-founded Insight Venture Partners in 1995.

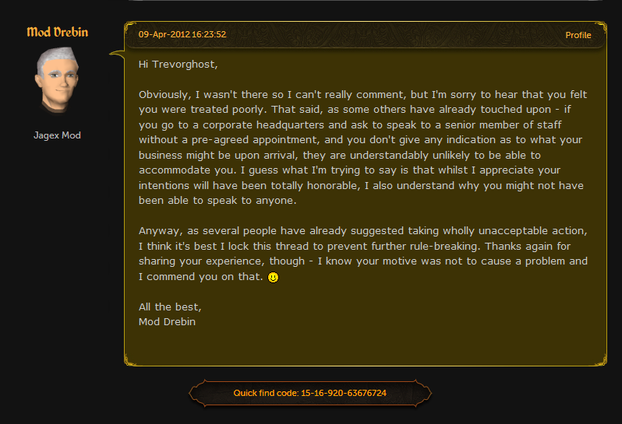

When the news broke that Andrew Gower had left Jagex (over a year after it actually happened), CEO Mark Gerhard was quick to reassure players.

When the news broke that Andrew Gower had left Jagex (over a year after it actually happened), CEO Mark Gerhard was quick to reassure players.

The first major story that will hit Runescape's information questers is a current situation unfolding at Quest Software Inc.

The first major story that will hit Runescape's information questers is a current situation unfolding at Quest Software Inc.

On the surface, none of this Wall Street wheeling and dealing should hold any relevance to Jagex nor its loyal player-base. After all, no lawsuit is likely to affect prices at the Grand Exchange in Varrock!

On the surface, none of this Wall Street wheeling and dealing should hold any relevance to Jagex nor its loyal player-base. After all, no lawsuit is likely to affect prices at the Grand Exchange in Varrock!

When 6Waves and Lolapps merged in 2011, it was supposed to be as a dual publishing and developing games company. It didn't quite work out like that.

When 6Waves and Lolapps merged in 2011, it was supposed to be as a dual publishing and developing games company. It didn't quite work out like that. Direct parallels can be drawn between

Direct parallels can be drawn between

St Tydecho's Churches in West Waleson 09/03/2014

St Tydecho's Churches in West Waleson 09/03/2014

Goodies for an Outlander Premiere Partyon 03/06/2015

Goodies for an Outlander Premiere Partyon 03/06/2015

Holocaust Memorial Day Interview with Rainer Höss, Grandson of Rudolf Architect of Auschwitzon 01/24/2015

Holocaust Memorial Day Interview with Rainer Höss, Grandson of Rudolf Architect of Auschwitzon 01/24/2015

Romantic Valentine Gifts for an Outlander Fanon 01/16/2015

Romantic Valentine Gifts for an Outlander Fanon 01/16/2015

Comments

*bows* Though it's more like Ms Journalist Girl. ;)

Though it's hard to feel smug about seeing the writing on the wall, when one of my favourite games was ruined in the process. :(

EVERYTHING ON THIS WAS PAGE WAS RIGHT OMFG...... YOU WERE RIGHT MR JOURNALIST GUY!

Then get thee to Wall Street and sort them out! We want our game back!

I am an American sadly.

Only those thinking with their bank accounts in Wall Street. I know plenty of American players, who are just as annoyed by developments as the rest of the world's players.

FUCK YOU PLUTOCRATIC AMERICA.

The Spirit of the Game is way more important in 2007 than EoC. Perhaps we ought to force all of the Jagex executive to play cricket, so they can first work out what the spirit of the game actually entails.

But they were also kinder times. Those of us with such responsibilities now suddenly got a glimpse of how it used to be. Ok, it was make-believe, pretend, but it allowed that level of escapism.

Runescape, to me, has always been about escapism. Getting the old crowd back would have been wonderful, but they couldn't be programmed in, as they were always real.

How very strange. I'll mention this to Simon (Wizzley's tech man) to see if he can shed any light on it.

To me, being able to finish quests more quickly, because you've been handed XP on a plate, is not a recommendation. It lessens the game, and therefore the achievement.

Do we actually need updates in 2007? Compare it to something like Portal, which is an amazing game, but doesn't have updates. Just throwing it out there. You may say that comparing Portal to RS is like comparing an orange to a potato. And that would be fair enough too!

Southeaster - You so called it. You told us that you doubted Caj would continue playing. :)