Claire Gordon reports (AOL, April 2013) that in the U.S. “The average big company CEO earns 354 times that of the average rank-and-file worker.” Scott DeCarlo wrote in Forbes magazine (April 2012) that “In 2011 the chief executives of the 500 biggest companies in the U.S…got a collective pay raise of 16 percent last year, to $5.2 billion. This compares with a three percent pay raise for the average American worker.” The standard rationale given by corporations for such enormous salaries is that they have to pay top dollar to get top quality talent.

Top Paid Business Executives

by RupertTaylor

The average top executive pay in the U.S. was $12.3 million in 2012. Are shareholders getting their money’s worth?

Study of Executive Effectiveness

An independent study suggests four out of ten CEOs aren’t worth their pay

The Institute for Policy Studies (IPS) in the United States publishes an annual report it entitles “Executive Excess.” The report deals head on with the corporate argument that in order to attract the highest quality executives businesses must pay high salaries and bonuses.

The Institute for Policy Studies (IPS) in the United States publishes an annual report it entitles “Executive Excess.” The report deals head on with the corporate argument that in order to attract the highest quality executives businesses must pay high salaries and bonuses.

In 2013, the group studied 241 “corporate chief executives who have ranked among America’s 25 highest-paid CEOs in one or more of the past 20 years.”

In the introduction to its 2013 report IPS notes “our analysis reveals widespread poor performance within America’s elite CEO circles.”

- Almost a quarter of CEOs (22 percent) headed companies that went bankrupt or required huge taxpayer bailouts to survive.

- Eight percent of the executives were fired.

- Another eight percent “led corporations that ended up paying significant fraud-related fines” shelling “out payments that totalled over $100 million per firm.”

As the IPS comments “nearly 40 percent of the CEOs on these highest-paid lists were eventually ‘bailed out, booted, or busted.’ ”

To which can be added the comment of Scott DeCarlo in Forbes who wrote that the magazine's 2012 "report on executive compensation will only fuel the outrage over corporate greed."

Executives Behaving Badly

Rich rewards come the way of executives for making decisions that are morally questionable

In 2012 The Institute for Policy Studies focussed on taxation issues. “We found that among the top 100 highest-paid CEOs in 2010, 25 had made more in personal compensation than their companies had paid in federal income taxes.” Those 25 companies had created among them 533 subsidiaries in tax havens such as the Cayman Islands, Bermuda, and Gibraltar so they could reduce their tax liabilities.

In 2012 The Institute for Policy Studies focussed on taxation issues. “We found that among the top 100 highest-paid CEOs in 2010, 25 had made more in personal compensation than their companies had paid in federal income taxes.” Those 25 companies had created among them 533 subsidiaries in tax havens such as the Cayman Islands, Bermuda, and Gibraltar so they could reduce their tax liabilities.

In 2010, the group found “that CEOs of the 50 firms that had laid off the most workers since the onset of the economic crisis had made nearly $12 million on average, 42 percent more than the CEO pay average at S&P 500 firms as a whole.”

Before that it was bank executives in the limelight. Many banks received taxpayer-funded bailouts following the 2008 financial meltdown. IPS found that among the 20 banks that got the most in rescue funds top executives “had averaged $32 million each in personal compensation during the three years leading up to the financial crisis. The very people whose reckless behaviour brought about the crash were richly rewarded for doing so.

Pay Structure Encourages Risky Decisions

High salaries and bonuses can be an incentive to act rashly

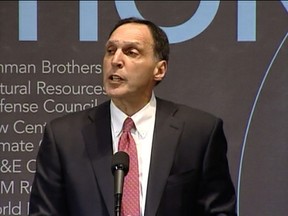

A major criticism of the huge bonuses paid to executives is that they often encourage them to make decisions for short-term gain at the expense of the long-term stability and financial health of an enterprise. Nowhere was this more evident than in the banking collapse of 2008, and one of the chief exponents of the high-risk strategy is Richard Fuld (left).

A major criticism of the huge bonuses paid to executives is that they often encourage them to make decisions for short-term gain at the expense of the long-term stability and financial health of an enterprise. Nowhere was this more evident than in the banking collapse of 2008, and one of the chief exponents of the high-risk strategy is Richard Fuld (left).

Described as driven and aggressive, Fuld was appointed chief executive of the Lehman Brothers financial services company in 1993. He set about turning the company around (it had lost $102 million the year he took over).

Not content with traditional investment banking Fuld started, “using borrowed money to play the [stock] market itself.” The story was detailed in a BBC documentary entitled The Love of Money. One clip shows Fuld saying he wants “to crush our enemies like this,” at which point he bares his teeth and growls. In another scene he gives a motivational talk to his staff saying that as far as his rivals are concerned “I want to reach down their throats and rip out their heart and eat it – before they die.”

The Love of Money

BBC documents the collapse of Lehman Brothers

The Collapse of Lehman Brothers

Richard Fuld’s risky business strategy enriched him but bankrupted his company

Lehman Brothers grew and grew by branching out into new products, many of them highly complex. Mathematicians were hired to design ever-more exotic investment vehicles; they carried names such as credit default swaps and collateralized debt obligations and few people understood what they were.

Lehman Brothers grew and grew by branching out into new products, many of them highly complex. Mathematicians were hired to design ever-more exotic investment vehicles; they carried names such as credit default swaps and collateralized debt obligations and few people understood what they were.

Richard Fuld understood them and knew them to be chancy, but he reasoned the way to make more money than his rivals was to accept more risk. The rule is that the riskier the investment the higher the rate of return and the bigger the bonus for the CEO. Between 1993 and 2007 Richard Fuld was paid nearly half a billion dollars.

By 2007, he had turned money-losing Lehman Brothers into a company that produced a profit of $4.2 billion. Institutional Investor magazine named him the top chief executive officer in America.

And, then it all fell apart. Much of Lehman’s investment was in the U.S. property market and, in 2006, house prices started to go down. Lehman’s shaky investment portfolio began to plummet in value. But Fuld made the dicey move of investing more borrowed money in the declining market; kind of like the gambler who looses a bet and doubles his next stake in hope of recovering. But, there was to be no recovery. In September 2008, the company was loosing money at the rate of $8 million a minute.

Very quickly the Lehman Brothers balance sheet became so toxic that nobody was willing to try to rescue it. On September 15, 2008 Lehman Brothers filed for bankruptcy and that event tipped over the already wobbly global financial system.

Richard Fuld Grilled by Congressional Committee

Sources

“CEOs Earn 354 Times More Than Average Worker.” Claire Gordon, AOL, April 16, 2013.

“America’s Highest Paid CEOs” Scott DeCarlo, Forbes, April 4, 2012.

“Executive Excess 2013: Bailed Out, Booted, and Busted.” Sarah Anderson, et al, IPS, August 28, 2013.

“The Love of Money.” BBC, October 1, 2009.

You might also like

BNSF's Case of Illegal Genetic Screening in the WorkplaceExamining a genetic testing case that set a precedent in regards to workplace...

How to Add Images to Zazzle CategoriesIt's easy to create a Zazzle category and then fill it with products, but the...

American Cop Shakedownon 09/16/2014

American Cop Shakedownon 09/16/2014

Cliven Bundy and the Sovereign Citizenson 08/05/2014

Cliven Bundy and the Sovereign Citizenson 08/05/2014

How Stores Manipulate Customerson 07/16/2014

How Stores Manipulate Customerson 07/16/2014

Corruption in Russiaon 06/27/2014

Corruption in Russiaon 06/27/2014

Comments

@RupertTaylor, while reading your insightful article on the dismal performance of U.S. company CEOs. I couldn’t help but feel the undertone of a political climate responsible for such shady dealings.

Big government regulation, fanny may and Freddie mac, too big to fail and all that bull crap

teddletonmr